The Cleveland County assessor’s office records constitute the report or estimate of all property and taxable persons in the county Assessor; therefore, they need to be accurately recorded and well maintained.

The Cleveland County assessor’s office records constitute the report or estimate of all property and taxable persons in the county Assessor; therefore, they need to be accurately recorded and well maintained.

Or

A Cleveland County Assessor surveyor is entitled to the salary established for his position by applicable law and the award of the court of magistrates. Still, he must keep the various commissions and fees he earns while performing his Cleveland County Assessor surveyor duties. Only an officer or administrator of the Cleveland County Assessor treasury is authorized.

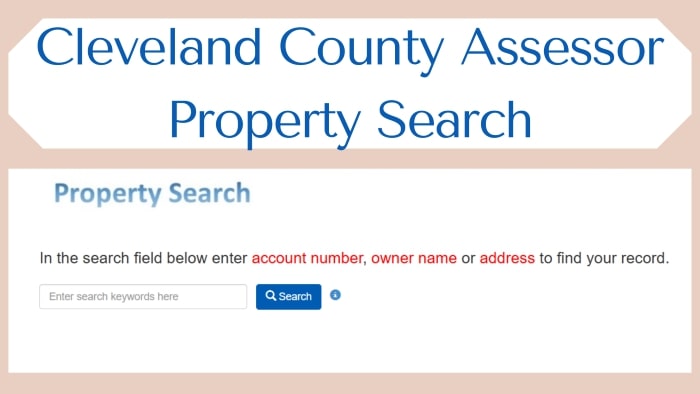

Navigating Your Property Search

Visit our website: Start your real estate exploration journey at www.clevelandcountyassessor.us. The Cleveland County Auditor’s site has user-friendly navigation and many real estate-related resources.

Property Address Search: Enter the address of a specific property to find information about it quickly. Discover details like assessed value, property dimensions, and tax information. Lot Number Search: Having a lot number allows you to access detailed property records quickly and efficiently.

Lot Number Search: Having a lot number allows you to access detailed property records quickly and efficiently.

Interactive Maps: Explore Cleveland County using our interactive maps. Identify properties, read reviews, and gain valuable local real estate market insights.

Property Records—Access official property records, including deed information, past sales, and ownership history, conveniently and anytime.

Sales history and value – Research a property’s sales history and value to understand market trends.

Tax Exempt Entities

- Value tax exemptions for fraternal, religious, and charitable institutions

- Ownership of fraternal, religious, and charitable organizations may be exercised according to Article 10, Section 6 of the Oklahoma Constitution and Section 2887, Title 68 of the Cleveland County Ok Property Search Statute.

- Ad valorem tax exemptions are permitted for qualifying institutional properties on an installment basis. They are dependent on the property’s ownership and use.

- Ad valorem tax exemptions are not automatic. For property owned by a church or charity, an affidavit showing the use of the property must be submitted to the Cleveland County Assessor. The declaration serves as the basis for determining the property’s tax status.

- Declaration forms, available from the Cleveland County Assessor office, list items that may be required to substantiate an ad valorem tax exemption claim.

Classification Notice

If the Cleveland County Assessor increases a property’s appraisal from the previous year’s, a written notice will be sent to the record owner. You can check your notice status at www.clevelandcountyok.com

Objection to actual monetary fair value

The Taxpayer must respond in writing if it disagrees with the Cleveland County Assessor’s action; the Taxpayer must respond in writing within 20 (twenty) business days from the date of sending the notification. The application must be filed on a form prescribed by the Cleveland County Assessor Ok Tax Commission, available at the Cleveland County Assessor assessor’s office. (OTC #974) The request must be accompanied by reasons for disagreement and the Taxpayer’s opinion on the fair value.

The review team will hold an informal hearing and consider any evidence presented. The final decision on the informal appeal will be made within 5 (five) business days of the hearing. The Taxpayer will receive an email informing them of this action.

Geographic Information Systems (GIS)

Another set of lines is drawn at 24-mile intervals north and south of the baseline, along with lines east and west of the prime meridian. East-west lines are called standard matches or correction lines. They form a continuous, unbroken line. The north and south lines, called prime meridians, do not extend their entire length. If the meridians converge as they approach the poles, they should break at the baseline and each standard parallel. We can create a square of 24 miles using prime meridians and standard parallels. There are sixteen townships within each of these 24-mile squares. A church is, as far as possible, six miles by six. A line of counties running from north to south is called an interval, and a line from east to west is called a plain. Each parish is divided into 36 one-square-mile areas called sections.

We can create a square of 24 miles using prime meridians and standard parallels. There are sixteen townships within each of these 24-mile squares. A church is, as far as possible, six miles by six. A line of counties running from north to south is called an interval, and a line from east to west is called a plain. Each parish is divided into 36 one-square-mile areas called sections.

Sections can also be subdivided. The fourth section (160 acres, 1/2 square mile), the fourth or eighth section (80 acres, 1/4 mile by 1/2 mile), and the fourth or sixteenth section (40 acres, 1/2 4 miles). 1/4 mile) mile). ). The quarter section is the minimum legal subdivision under general land laws, but it is common to further subdivide the subdivision for descriptive purposes.

Renovation:

- If you received a Homestead Exemption and continue to occupy the Cleveland County Assessor Property, you do not need to apply for Homestead Exemption again.

- If you are the head of the household and qualify for the Homestead Exemption, you may also qualify for additional housing. If your gross household earnings from all sources were less than $20,000 in the most recent calendar year, you may be eligible for an extra $1,000 Cleveland County Tax Assessor exemption.

How Does a County Assessor Do Their Job?

The District Advisory Board is responsible for:

- Lists and maintains records of all taxable real estate and personal property in Cleveland County Assessor Property Search. Real estate includes land and buildings. Personal Cleveland County Property Search includes business equipment and accessories, business equipment, business inventory, agricultural equipment, and manufactured homes. As a Cleveland County Assessor Property Search, Doug Warr is responsible for the fair valuation of all taxable property in Cleveland County Assessor Property Search. The individual lots now number nearly 100,000 and cover an area of 530 square miles. The availability of information in multiple formats has increased dramatically in recent years. Follow this link(www.clevelandcountyok.com) to view Advisor logs.

- Annually evaluates the fair market value of homes, businesses, and other Cleveland County Tax Assessor property in Cleveland County Assessor Property Search. The market value may increase or decrease depending on the department’s housing market.

- Notifies owners of any increase in the market value of their Cleveland County Property Search. Helps taxpayers file property tax exemptions and property tax returns that are exempt under Cleveland County Assessor Ok law.

- Resolve doubts or protests regarding classification.

- Preparation and certification of documents and Cleveland County Tax Assessor records.

- Appears before the EQUALIZATION COUNTY.

| Official Name | Cleveland County Assessor |

|---|---|

| Use of Portal | Property Search |

| Country | United Stated |

| Language | English |

| Sector | Property |

State Property Tax Credit or Rebate Program Information

Form 538-H must be completed and sent to the Cleveland County Ok Tax Assessor Commission, 2501 Lincoln Blvd, Oklahoma City, Ok., 73194-0003. Individuals 65 years or older, fully disabled, head of household, resident in Cleveland County Ok Property Search for one year, and with a gross household income of less than $12,000 are eligible for this program. A copy of the required form is available from the Cleveland County Assessor office or the Cleveland County Ok Tax Assessor Commission at 521-3108.

Freeze Senior Grade

Requirements listed below:

- The head of household (as defined below) must be 65 or older by January 1 of the current year.

- The head of household must own and occupy their Cleveland County Property Search as of January 1 of the current year.

- Gross household income (as defined below) may not include H.U.D., the estimated average income for the previous calendar year.

- A senior rating freeze request must be made between January 1 and March 15 or within 30 days of notification of the rating upgrade. The freeze takes effect during the fiscal year when the request is submitted and approved. An annual application is optional.

A complete application with income, age, assets, and other information must be filed for the ban to be valid.

100% Exemption for Disabled Veterans

Based on State Question 715, approved in November 2004 and effective in January 2006.

General provisions: 100% exemption from the market value of properties suitable for family housing. The owner must be certified by USDVA as receiving 100% compensation as of September 23, 1998. The assessment is still ongoing, and no further review is planned. The holder must apply for OTC Form 998 on this website(www.clevelandcountyok.com). Proof of certification (USDVA qualification document) is needed with the application. Also, bring a photo ID.

Qualifications: Bachelor’s degree, 100% permanent disability, extends to surviving spouse, head of household, and USDVA-provided qualification.

About Cleveland County

Cleveland County is in the center of the US state of Cleveland County, Ok Tax Assessor. As of the 2020 US Census, its population was 295,528, making it the third most populous county in Cleveland County Ok Property Search. The capital is Cleveland County Assessor Norman Oklahoma. This Cleveland County Assessor is named after the third president of the United States, Grover Cleveland County Assessor Property Search.

A federal decree of 1866 obliged these tribes to cede their lands. The reason was their support of the Confederacy during the American Civil War. The area became part of the Unallocated Lands and was opened to white settlement on April 22, 1889.

After the Organic Act of 1890, Cleveland County Assessor Property Search was organized into three counties (out of seven), with Norman becoming the county seat. Until an election in 1890, Cleveland County Assessor Property Search was briefly known as Little River County. Voters chose the name Cleveland in honor of President Grover Cleveland County Assessor Property Search rather than Lincoln.

FAQs

Why should I be penalized for someone paying high prices for a house in my neighborhood?

It’s not a punishment; even if it happens, few people pay more for something than it’s worth. So when several homes equivalent to yours are traded for more based on the sales price paid by new residents, it increases the neighborhood’s market value and the market value of your Cleveland County Property Search if you decide to sell.

I have an old house in an area where new houses are being built. How does this affect the value of my property?

Newer homes do not directly affect their value. For appraisal purposes, we compare your home to similar Cleveland County Assessor properties by age, condition, size, and other variables.

If my true fair value didn’t increase, why did my taxes increase?

The Cleveland County Assessor needs to determine the amount of Cleveland County Tax Assessor you pay. Suppose the actual or taxable present value determined by the appraiser for your property has remained unchanged since last year. In that case, the increase in your Cleveland County Tax Assessor is likely due to increased mileage rates in your school district. Mileage levels are controlled by the popular vote, not the Cleveland County Assessor aide. Follow the link on the right to calculate your Cleveland County Tax Assessor.

Do you visit all the houses in the county? I didn’t speak to anyone.

Yes, Cleveland County Assessor Ok law requires that we visit all properties every four years. As our opening hours are similar to those of most professionals, it is uncommon for appraisers to find someone at home when visiting a property. However, we do our best to contact someone on the property to explain why we are there and resolve any issues the owners may have.

Conclusion

You can request an additional stay between January 1st and March 15th or up to 30 days after being notified of the increase. Please bring proof of the previous year’s household income so we can complete the application correctly. The additional stay does not need to be renewed each year. If you are 65 or older on March 15 of the application period and are currently eligible for an Additional Homestay, you do not need to renew it each year.